During June, we observe Elder Abuse Awareness Month to shine a light on the troubling and often hidden issue affecting millions of older adults worldwide. Elder abuse can take many forms. It could be physical, emotional, or financial, and it could be due to neglect or to exploitation. Often, elder abuse goes unreported as a result of fear, shame, or isolation.

Perhaps it’s the over-indulgence from holiday parties and family meals, or the idea of a fresh start that makes us want to change our habits. However, the dream of change and new beginnings can slip away almost as soon as the resolutions are made. In fact, according to businessinsider.com less than 10% of people actually achieve their goals and 25% quit within their first week! Those are tough statistics but there are proven ways to help you stick to your New Year’s Resolutions!

Perhaps it’s the over-indulgence from holiday parties and family meals, or the idea of a fresh start that makes us want to change our habits. However, the dream of change and new beginnings can slip away almost as soon as the resolutions are made. In fact, according to businessinsider.com less than 10% of people actually achieve their goals and 25% quit within their first week! Those are tough statistics but there are proven ways to help you stick to your New Year’s Resolutions! Tips for Black Friday and Cyber Monday Shopping

Tips for Black Friday and Cyber Monday Shopping Fall has arrived, are you ready for the cooler weather? Have you taken the time to prep your home for the cold weather? Residential electricity rates have risen on average about 15% nationwide over the last 10 years, an increase of about $0.02 per year. Consumers who use oil heat are expected to pay about 20% more this year than last year.

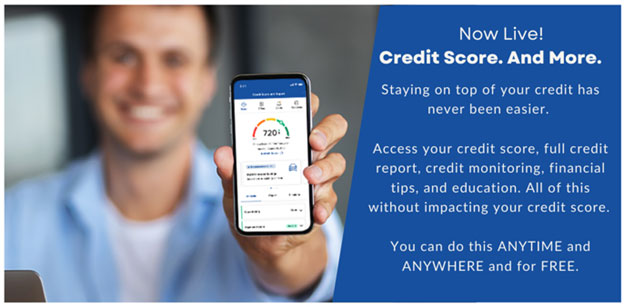

Fall has arrived, are you ready for the cooler weather? Have you taken the time to prep your home for the cold weather? Residential electricity rates have risen on average about 15% nationwide over the last 10 years, an increase of about $0.02 per year. Consumers who use oil heat are expected to pay about 20% more this year than last year. Mobile Deposit Capture also know as Mobile Deposit is an easy and convenient way to deposit checks directly from your phone. At ECU Credit Union, if you are unable to come to us – we want YOU to be able to have the resources to make your life as convenient as possible.

Mobile Deposit Capture also know as Mobile Deposit is an easy and convenient way to deposit checks directly from your phone. At ECU Credit Union, if you are unable to come to us – we want YOU to be able to have the resources to make your life as convenient as possible.